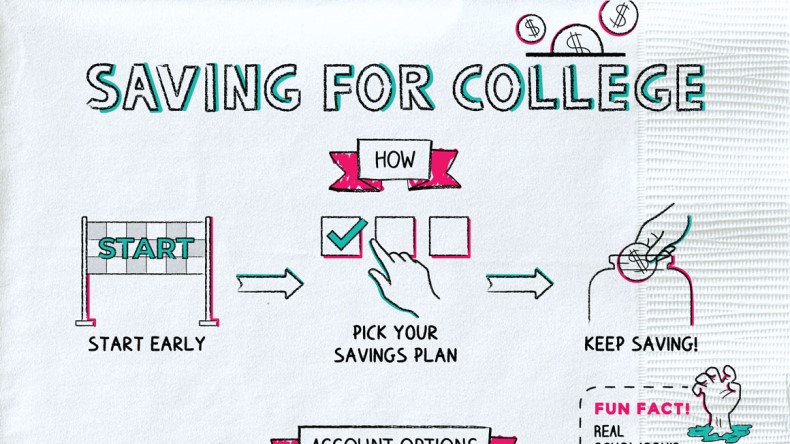

Building Tomorrow's Success: Just how to Save for College Expenses

Navigating University Costs: Expert Financial Planning Recommendations for Pupils

As college tuition continues to increase, pupils are encountered with the difficult task of navigating their expenditures. In this conversation, we will explore various techniques for understanding university expenses, developing a budget, discovering monetary aid options, conserving on books and materials, and managing living expenditures.

Recognizing College Expenses

Recognizing college expenditures is essential for pupils and their family members in order to make enlightened financial choices and prepare for the prices connected with greater education. University expenses include a variety of financial obligations that pupils need to take into consideration before beginning on their scholastic journey. These expenses consist of tuition costs, holiday accommodation products, costs and books, dish plans, transport, and miscellaneous expenses.

Tuition charges are usually the largest expense for students, and they differ depending on aspects such as the kind of institution, program of research, and residency standing. Materials and textbooks can also be a considerable expenditure, specifically for programs that need specific materials.

To acquire a comprehensive understanding of college expenditures, pupils and their households need to investigate the certain expenses connected with the programs and institutions they are taking into consideration. They ought to likewise check out prospective sources of financial help, scholarships, grants, and work-study possibilities to aid offset several of these expenses. By comprehending university expenditures, trainees can make enlightened decisions about their financial future and guarantee that they are properly prepared to satisfy the financial needs of higher education and learning.

Developing a Budget

To successfully handle university expenses, pupils and their families should establish a spending plan that makes up all economic commitments and makes certain liable spending throughout their scholastic trip. Developing a budget plan is an important step in financial planning, as it permits individuals to track their income and costs, and make informed decisions about their investing habits.

The initial step in developing a spending plan is to establish all sources of income. This might consist of scholarships, grants, part-time tasks, or payments from relative. Save for College. It is very important to have a clear understanding of the overall quantity of cash offered every month

Following, pupils need to determine all essential expenditures, such as tuition costs, textbooks, food, transport, and real estate. It is important to focus on these expenditures and designate funds accordingly. In addition, pupils ought to also take into consideration reserving money for emergency situations or unanticipated expenditures.

When revenue and costs are determined, it is essential to track spending often. This can be done via budgeting applications or straightforward spreadsheets. By keeping track of expenditures, pupils can recognize locations where they may be overspending and make modifications accordingly.

Developing a budget not just aids pupils remain on track monetarily, however it also promotes liable costs behaviors that can be brought into the future. By sticking and developing a spending plan to it, trainees can navigate their college expenses with self-confidence and convenience.

Exploring Financial Assistance Options

They do not require to be paid back, making them an attractive choice for several students. It is essential for pupils to research study and use for scholarships that align with their certifications and interests.

Grants are an additional sort of financial assistance that does not need repayment. These are typically awarded based on financial need and are provided by the federal government, state governments, or colleges view publisher site themselves. Trainees need to complete the Free Application for Federal Pupil Aid (FAFSA) to determine their qualification for gives.

Lastly, student financings are an additional choice for funding college expenses. Unlike gives and scholarships, financings should be repaid with passion. Pupils need to very carefully consider their finance choices and borrow just what is essential to stay clear of too much financial obligation.

Conserving on Textbooks and Products

As trainees discover monetary aid options to ease the burden of university costs, locating ways to reduce books and supplies becomes critical (Save for College). Books can be a considerable cost for pupils, with prices often reaching hundreds of dollars per book. Nonetheless, there are numerous approaches that pupils can employ to save cash on these crucial resources.

An additional alternative is to get used textbooks. Lots of university universities have bookstores or on the internet marketplaces where students can offer and acquire used textbooks, typically at significantly decreased costs.

Students can additionally check out digital options to physical books. E-books and online resources are coming to be significantly preferred, supplying pupils the ease of accessing their called for analysis products electronically. Furthermore, some internet sites supply cost-free or low-priced books that can be downloaded or accessed online.

In regards to materials, trainees can conserve money by purchasing wholesale or making use of back-to-school sales. It is additionally worth inspecting with the university or university's bookstore for any discounts or promotions on products. Pupils should think about obtaining supplies from classmates or buddies, or making use of campus sources such as collections and computer system laboratories, which commonly provide access to necessary supplies at no price.

Taking Care Of Living Expenditures

Managing living expenses is a critical aspect of college economic preparation - Save for College. As a trainee, it is essential to produce a budget that represents all your important living expenditures, such as real estate, food, transport, and energies. By handling these expenditures successfully, you can ensure that you have adequate money to cover your fundamental demands and stay clear of unneeded economic tension

One method to handle your living expenditures is to discover budget friendly housing options. Think about living on campus or sharing an apartment or condo with flatmates to split the expense. In addition, discover various meal plan choices or prepare your own dishes to save money on food expenditures. Transport costs can also be minimized by making use of mass transit, car pool, or biking to university.

To effectively manage your living expenditures, it is important to track your spending and develop a monthly spending plan. This will certainly aid you recognize areas where you can cut down and save cash. Search for student discount rates or totally free events on university for entertainment options that will not spend a lot.

Verdict

In verdict, understanding university expenses and producing a budget are critical steps for students to effectively handle their financial resources. By implementing these techniques, students can navigate university expenses navigate to these guys and improve their economic health.

By recognizing university expenses, pupils can make educated decisions concerning their monetary future and make sure that they are properly prepared to meet the monetary demands of greater education and learning.

As pupils explore economic help options to ease the burden of college expenses, locating means to save on textbooks and supplies comes to be important.